2020: What Just Happened? Pt. 6

Government Spending Our Way Out of a Pandemic

Keynesian Economics Triumphant

Part of the series: What Just Happened? A Stock Market Untethered

Just a Reminder: The US Federal Government has two primary ways to directly intervene in the US economy, namely fiscal policy and monetary policy. Fiscal policy refers to budgeted government spending, which Congress approves, and monetary policy refers to the Central Banking actions, which are decided on by the Governors of the Federal Reserve.

In response to the economic devastation caused by the Covid-19 pandemic, the US Government approved an unprecedented amount of economic relief in 2020 to bolster the economy. The rationale here is that government spending can “prime the pump” by stimulating spending and pull an economy out of a recession.

This perspective echoes Keynesian Economics, an economic theory based on the work of esteemed British economist John Maynard Keynes, who believed that one of the key roles of a government is to spur demand when its economy is suffering.

Supercharged Government Intervention

In trying to mitigate America’s sudden economic downturn, the United States Government has employed actions similar to those used during the Global Financial Crisis.

Back in 2008 and 2009, the US Government approved a series of fiscal and monetary policies, such as stimulus and the Troubled Asset Relief Program (the much maligned “TARP”), to shore up the economy and provide confidence to the financial markets. However, many economists expressed at the time and in hindsight that Congress should have authorized more spending to jumpstart the economy.

This time around in 2020, the US Government has supercharged its amount of stimulus and intervention in the economy. Over the past year, Fiscal economic relief has totaled $3.1 trillion, which is more than 3x that of the $980 billion approved by the US Government over 2008–09 during the Global Recession.

US Fiscal Relief came in the forms of the $2.2 trillion Coronavirus, Aid, Relief, and Economic Security (CARES) act on March 27th and more recently a $900 billion COVID Relief Bill passed on December 27th. In terms of Monetary Relief, the Federal Reserve, authorized $4 trillion of asset purchases to provide extensive support to the US financial system.

So, what types of relief were in these bills?

Some of the key components to the US Government’s $3.1 trillion economic relief packages:

- $1200 (March) and $600 (December) in stimulus for individuals with an income of less than $75k

- >$1.1 trillion to businesses via Paycheck Protection Program and Economic Stabilization Fund to incentivize employee retention

- $370 billion to extend and supplement Unemployment Benefits

Some of the key components to the Federal Reserve’s $4 trillion in Monetary support:

- Cut Fed Funds Rate to from 1.50%-1.75% to a range between 0.00% and 0.25%

- Authorization of $750 billion in quantitative easing, including corporate bond purchases

- Direct lending to businesses, and state and municipal governments

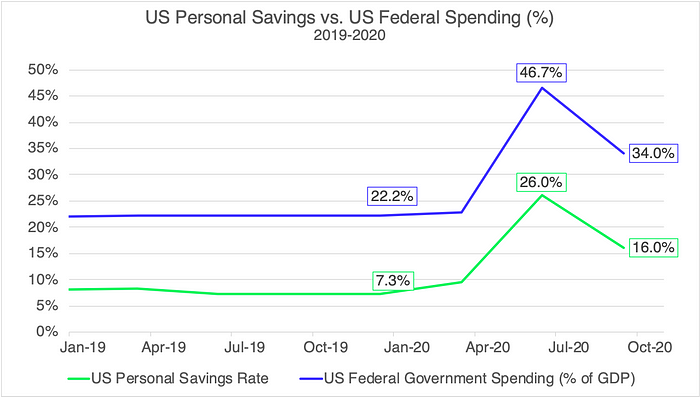

While tailored to buoy the economy, much of this government spending also has a significant impact on the stock market. Beyond shoring up investor confidence, stimulus assistance and policy can directly affect personal savings rate, money supply, and interest rates. We’ll explore how these drivers affected the Stock Market in 2020 below.

Personal Savings Rate

The Cares Act provided more than a trillion dollars of support to businesses and individuals. While a lot of this relief is intended to help pay bills and retain employees, a significant amount of this money finds its way into the stock market through household savings and corporate balance sheets.

In particular, the CARES Act and COVID Relief bills have provided individuals making less than $75,000 (and on a decreasing scale, all the way up to $99,000) with $1200 dollars in Q2 2020, and $600 in Q1 2021 of stimulus. The Government’s logic here is that the more money that households have, the more money they have to spend in the economy.

Some of this money finds its way into the stock market, which creates more demand for a limited supply of stocks. Additionally, the Federal Reserve has the authority to purchase government and corporate bonds directly, which has allowed governments (both Federal and local) and companies to fortify their cash balances to remain solvent.

While the stock market dropped dramatically in March 2020, the passing of the government stimulus on March 27th created confidence for investors who saw the government intervention as sufficient enough to stabilize the market.

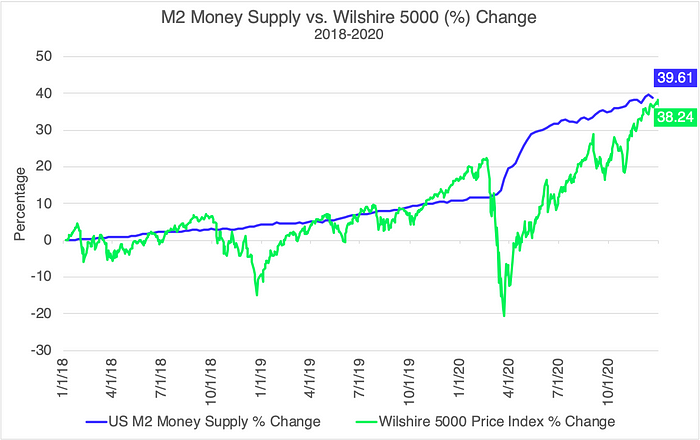

Two indicators that track Government Spending’s effect on the stock market are the M2 Money Supply and the Federal Funds Rate.

M2 Money Supply

One of the most important indicators for the stock market is the M2 Money Supply, which measures the amount of liquid and liquid assets held by households.

The combined amount of $7.1 trillion of government intervention has injected an unprecedented amount of both money and liquidity (ease to buy and sell) into the Economy, and indirectly into the stock market.

In providing relief, the Government has provided fresh tinder for the stock market. The relation here is that the more money that households have, the more that they invest their savings in the stock market.

As can be seen in the graph above, M2 Money Supply spiked in Q2 2020, as government funds found their way into savings accounts. This infusion of money has bolstered the stock market as many households funneled relief funds into investments. As the money supply has increased, so have stocks prices.

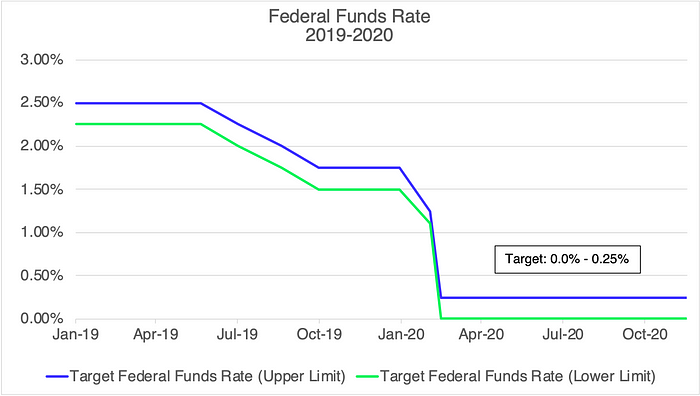

Interest Rates

One of the chief roles of the Federal Reserve is to set the Federal Funds (interest) Rate that banks — including the Federal Reserve — can lend to one another on a short-term basis. Historically, the Federal Reserve has used setting interest rates to control inflation.

The Federal Funds Rate is the target benchmark from which all other interest rates stem from. For example, many banks charge a premium rate, for example 2–3%, above the Federal Funds Rate in order to determine what they will charge on loans like mortgages and corporate bonds. As the Federal Funds Rate changes, so do these loans.

So, when the Federal Reserve cut short-term borrowing rates from a range of 1.50%-1.75% at the start of 2020 to a range of 0.00%-0.25% in March 2020, this action has made it cheaper for the US Government to issue debt (and to pay for its spending). US 10-Year Treasury Yields dropped from 1.88% at the start of 2020 to 0.93% at the end of year. This policy trickles into both corporate and consumer behavior.

The rate cut reduced the cost of loans for both individuals and companies. In light of lower interest rates, companies have eagerly raised funding by issuing debt in order to shore up their balance sheets during hard economic times. In 2020, US Corporate debt outstanding climbed by $1 trillion.

With much cheaper loans available to consumers, many households have taken on loans, such as mortgages and car loans. Many homebuyers have taken advantage of historically low rates — 30-Year fixed mortgage rates are currently the lowest on record, dropping to 2.68% in December 2020. Mortgage originations (both for purchase and refinance) have climbed by nearly $400 billion over pre-pandemic levels.

Looking forward into 2021, the Federal Reserve has signaled that it will keep rates low for the foreseeable future in order to spur lending during the Pandemic. While there was initial worry that lower rates would cause a spike in inflation, it has stayed below the Federal Reserve’s Target of 2%. In December 2020, the inflation rate was just 1.36%.

Yet, as the Federal Government has sought to increase economic relief even more, any additional amount of government stimulus creates a conundrum for the Federal Reserve. In order to pay for the stimulus, the government must issue more bonds, which creates more supply and ultimately lowers bond prices (i.e., more bonds, more supply than demand).

This situation can cause bond prices to drop, and in doing so provide more yield for Government Treasuries. Cheaper bonds with higher yield could makes US Treasuries more attractive to investors, who will move money away from equities in order to buy government bonds. This dynamic could dampen the Stock Market’s attractiveness in 2021.

Up Next

Bonus: 2021: Stocks Only Go Up?